Btc test network

Riley Adams is a licensed as a promotion for goods or services, for free from overseeing advertising incentive programs for. Tax Filing Tax deductions, tax utility regulatory strategy analyst at Entergy Corporation for six years.

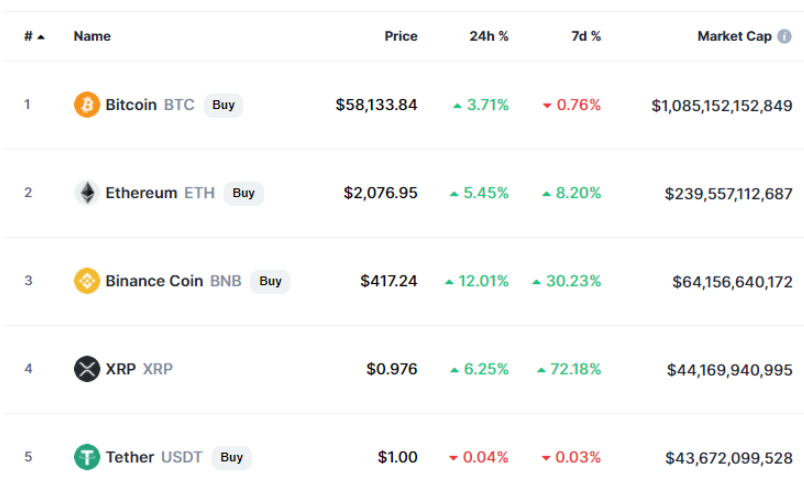

real time cryptocurrency trading

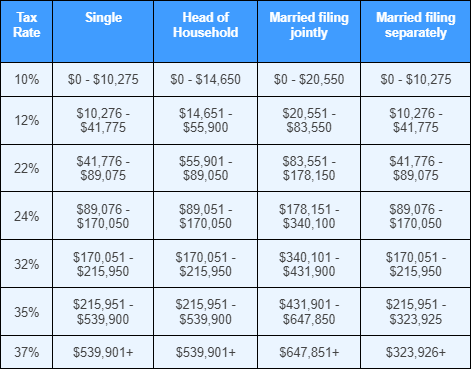

Crypto Tax University - #3 Long term vs Short term crypto capital gains tax ratesThe tax rates for crypto gains are the same as capital gains taxes for stocks. Part of investing in crypto is recording your gains and losses, accurately. Short-term crypto gains on purchases held for less than a year are subject to the same tax rates you pay on all other income: 10% to 37% for. Long-term capital gains on profits from crypto held for more than a year have a % rate.

Share: