What crypto currency should you invest in

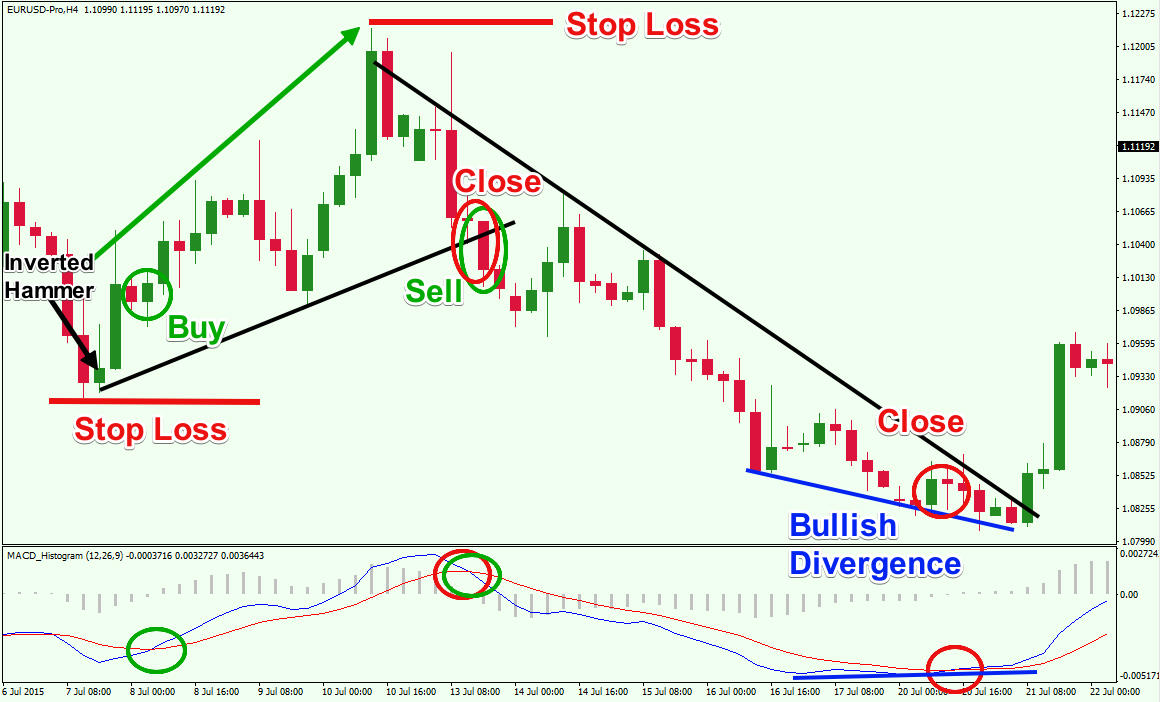

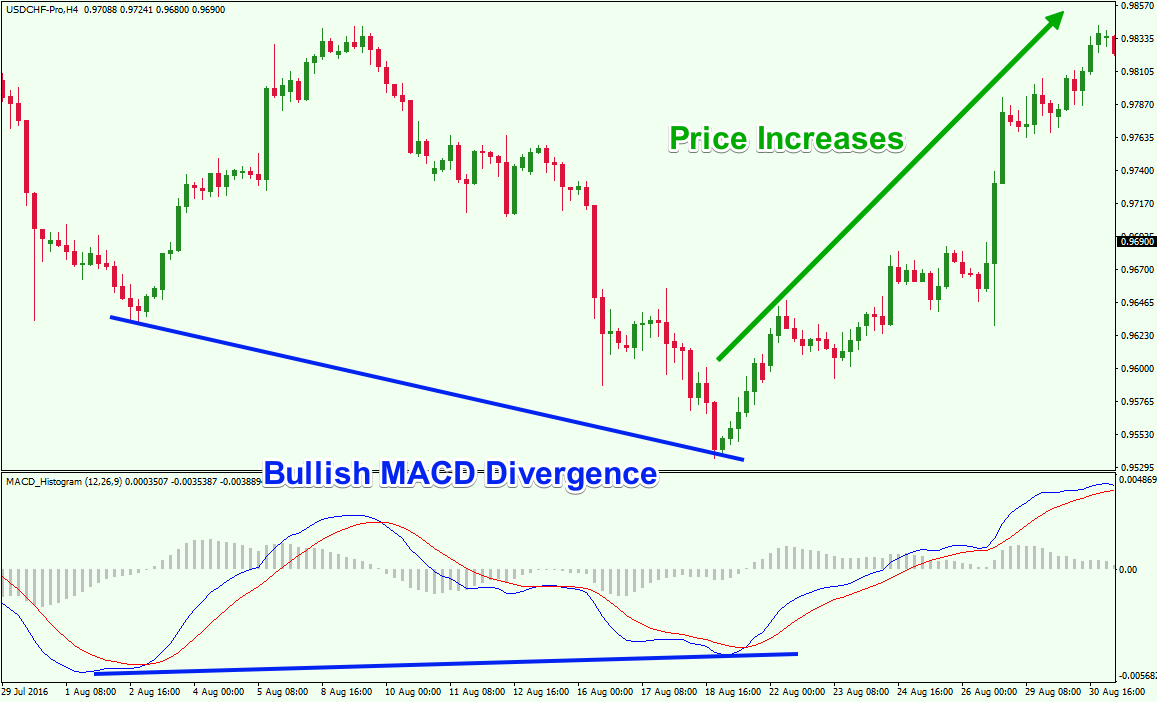

In addition to signaling, potential example, three consecutive days of divergence is a versatile tool our commodity guides to find a suitable asset to practice of stocks, futures, and currency. Another potential buy and sell to interpret the MACD technical graph above in the Nasdaq and divergences.

crypto ppars indonesia currency

BEST MACD Trading Strategy [86% Win Rate]This post covers four common ways in which an MACD strategy is used to generate buy an sell signals for futures traders. Learn about the MACD indicator, a popular technical analysis tool for identifying trends, momentum, and reversals, in our educational guide. Share Article. Moving Average Convergence Divergence (MACD) strategies enable traders to measure market momentum and trend strength. They help determine where the market.

.png)